Today updates

Direct Tax:

Rental income taxed as business income as it was only source of income which was consistently treated as such Agya Ram v. Commissioner of Income-tax, Delhi 2016] 72 taxmann.com 287 (Delhi)

TDS u/s 194LA attracted on acquisition of building on agricultural land which wasn’t agricultural Godown Commissioner of Income-tax (TDS) v. Special Land Acquisition Officer [2016] 72 taxmann.com 255 (Gujarat)

No addition u/s 69B on basis of inflated stock statement sent to bank for availing of higher credit Commissioner of Income-tax-I v. Vrundvan Roller Floor Mill [2016] 72 taxmann.com 250 (Gujarat)

Commission paid to NR agent for rendering services outside India isn’t taxable in India

Income-tax Officer, Ward 2 (1)(1), Ahmedabad v. Excel Chemicals India Ltd.

[2016] 72 taxmann.com 284 (Ahmedabad – Trib

ITAT delhi in the below citied case held that as per the provisions of Section 170(2), in the case of amalgamation, the assessment must be made on the successor i.e. the amalgamated company and not on the predecessor i.e. amalgamating company.[Maruti Suzuki India Ltd. Vs. DCIT, New Delhi]

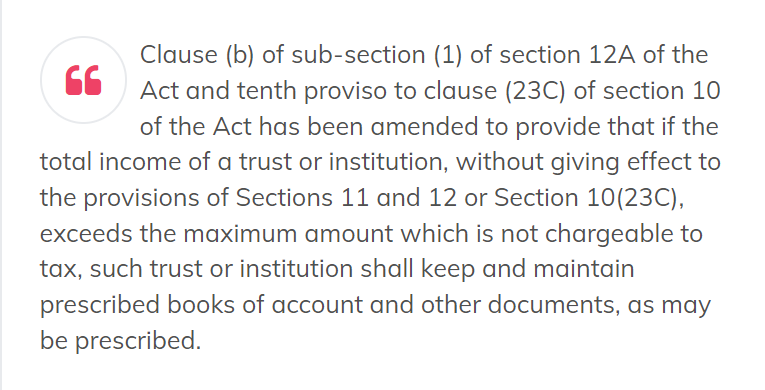

New IT Rule 17AA : NGOs need to maintenance of Books u/s 10(23C) or Section 12A

INDIRECT TAX:

New Automation Process for Filing of MVAT and CST Returns has been issued under circular no. 22T of 2016.

HC criticizes Delhi VAT Commissioner for delaying refund; asked to issue refund along with interest 2016] 72 taxmann.com 242 (Delhi) Prime Papers & Packers v. Commissioner of VAT

ST: Non fulfilling the obligation to deposit the collected tax to the Government of India – No reason to disbelieve their claim of inability to pay tax owing to lack of funds. Such possibilities can and do occur in the world of business. – Levy of penalty waived – CST, Mumbai Vs. Shlok Media Pvt. Ltd. (Vice-versa) (2016 (8) TMI 1123 – CESTAT MUMBAI)

DVAT: The due date of filing of online return for 1st Qtr of FY 2016-17 in Form DVAT-16, DVAT-17 and DVAT-48 along with required annexure / enclosures has been extended to 10 SEP 2016 – Circular No. 13 of 2016-17, dt.31 Aug 2016.

ST: Cenvat Credit – refund – export of services – The registration is not the sole criteria for granting refund so long the other conditions are satisfied refund shall be granted – C Bay Remote Services Pvt. Ltd. Vs. CST-II (2016 (8) TMI 990 – CESTAT Mumbai)

CBEC has issued a clarification regarding revised guidelines for disposal of confiscated goods vide Circular no. 39/2016 dated 26/08/2016. (Click here to view)

CBEC has issued a notification regarding handling of Cargo in Custom Area (Amendment) Regulation, 2016 vide Notification No. 115/2016 dated 26/08/2016. It Provided that the condition of furnishing of bank guarantee shall not be applicable to ports notified under the Major Ports Act, 1962 (38 of 1963) or to the Central Government or State Governments or their undertakings or to the customs cargo service provider authorised under Authorised Economic Operator Programme. (Click here to view)

AAR holds that process of crushing coal before supplying to customers does not amount to ‘manufacture’ u/s 2(f) of Central Excise Act; Observes that even after crushing the imported coal of different sizes, it will neither lose its character nor will result in new product; Hence, activity would not be covered as ‘manufacturing activity’ nor crushed coal would be ‘manufactured product’. [TS-321-AAR-2016-EXC]

Madras HC upholds Single Judge Bench order, finds no reason to interfere with show cause notice issued by Central Excise Officer alleging misuse of advance authorization scheme by diverting imported inputs / finished goods into domestic market and mis-utilization of CENVAT credit thereto. It Rejected assessee’s stand that Excise Officers lack jurisdiction to enquire into allegations of offences under Customs Act and Foreign Trade (Development & Regulation) Act r/w EXIM Policy. [TS-312-HC-2016(MAD)-CUST]

MCA UPDATES:-

Forms DIR-3, INC-2, SH-11, CHG-4 and INC-4 are likely to be revised on MCA21 Company Forms Download page w.e.f 2nd SEP 2016. Stakeholders are advised to check the latest version before filing. (Click here to view)

NCLT has issued an order under the provisions of the Rule 89 of NCLT Rules, 2016 has approved the format of daily cause list. The new format of the cause list shall have all the mandatory details as provided in the Rule 89 like CP/CA NO. Purpose, Section under which the case has been filed, Name of the Parties, Name of the legal Practitioners and Remarks.

An arbitrator has no power to award pendent lite interest if the same is barred expressly by the contract. It would depend on the nature of the ouster clause in the contract. [Union of India vs. Ambica Construction (SC of India)].

Company e-Forms AOC-4, AOC-4 CFS, DIR-12, and FC-2 & MGT-15 revised on MCA portal. Download the latest version of forms W.e.f 24.8.16 for e-filing.

MCA has notified the provisions of section 188 to 194 of the Insolvency and Bankruptcy Code 2016.

Use latest version of e-Forms DIR-3, INC-2, SH-11, CHG-4 and INC-4 which are likely to be revised on MCA21 portal W.e.f. 2nd SEP 2016.

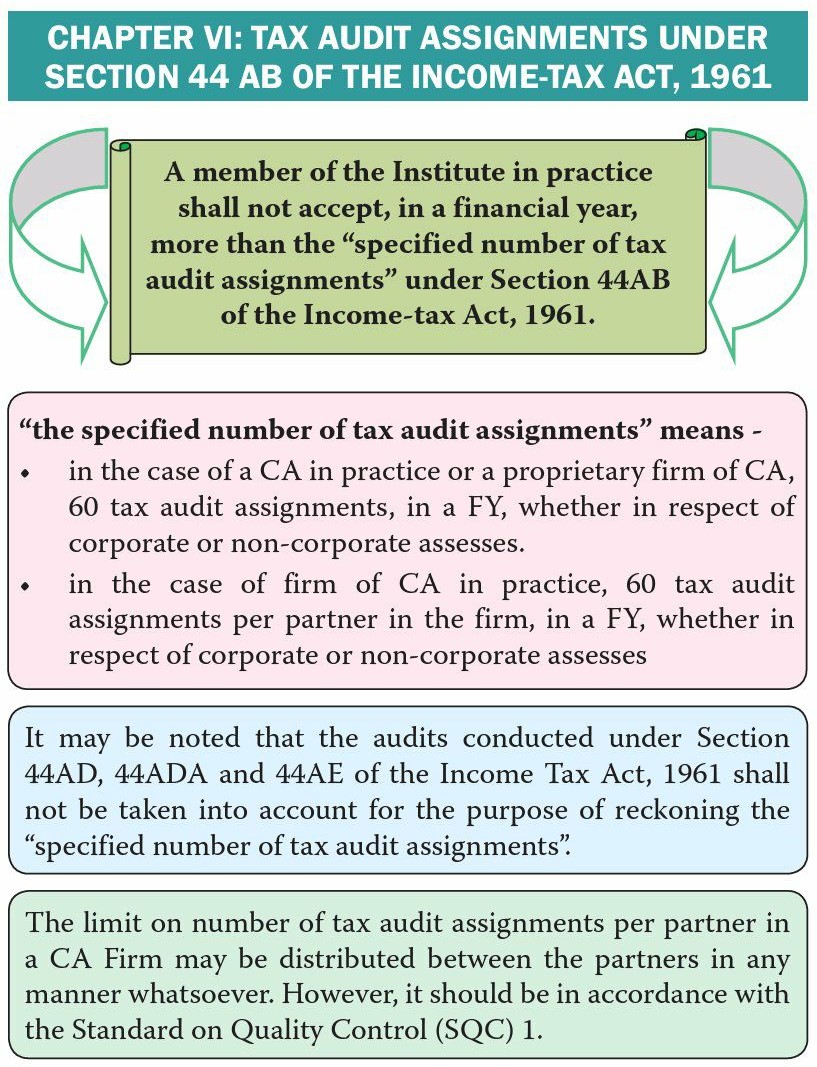

ICAI Updates:-

MEF: The last date for online filing of Multipurpose Empanelment Form 2016-17 has been extended to 10 SEP 2016.

The Auditing and Assurance Standards Board of ICAI has issued Implementation Guide on Audit of Internal Financial Controls over Financial Reporting with Specific Reference to Smaller, Less Complex Companies. This Implementation Guide should be read in conjunction with the Guidance Note on Audit of Internal Financial Controls over Financial Reporting in case of smaller, less complex companies.(Click here to view)

SEBI UPDATE

CL: Violation of Clause 49 of the Listing Agreement – Whole Time Director chaired the Audit Committee Meeting – levy of penalty of ₹ 5 Lac cannot be said to unreasonable or excessive – Mr. Sandeep Baid and Ors. Vs. SEBI, Mumbai (2016 (8) TMI 968 – SAT, Mumbai)

NCLT has issued an order under the provisions of the Rule 89 of NCLT Rules, 2016 has approved the format of daily cause list.

OTHER UPDATES:-

EPFO has issued an instruction on Claim Form No. 31 – Instruction on submission of declaration Form therewith. Attestation of an employer on the Declaration form would not be required for both Form No. 31 & Form No. 31(UAN). However, the Claim Form No. 31 shall continue to be attested by the employer.(Click here to view)

Advocates Act : Rules 3 and 3A of the Allahabad High Court Rules, 1952 which mandates that a lawyer outside state cannot appear in Court without a Local lawyer’s appointment are perfectly valid, legal and do not violate right of appellant under article 19(1) (g) of the Constitution [2016] 72 taxmann.com 331 (SC) Jamshed Ansari v. High Court of Allahabad

Key Dates:

- Filing of ITR returns by Individuals, HUF (With Audit): 30/09/2016

- Filing of ITR returns by all companies (except TP audit): 30/09/2016

- E-Payment of Service Tax for August by Companies: 06/09/2016

- E-Payment of TDS for August : 07/09/2016

Silence of a genius is more dangerous than weapons with great noise, and patience of a good person is powerful than anger of thousand fools.

There was never a night that could defeat sunrise, as equally there is never a problem that could defeat hope. Hope for the best always.

We look forward for your valuable comments. www.caindelhiindia.com

FOR FURTHER QUERIES CONTACT US:

W: www.caindelhiindia.com E: info@caindelhiindia.com T:011-233-4-3333 , 9-555-555-480

Disclaimer:

All efforts are made to keep the content of this site correct and up-to-date. But, this site does not make any claim regarding the information provided on its pages as correct and up-to-date. The contents of this site cannot be treated or interpreted as a statement of law. In case, any loss or damage is caused to any person due to his/her treating or interpreting the contents of this site or any part thereof as correct, complete and up-to-date statement of law out of ignorance or otherwise, this site will not be liable in any manner whatsoever for such loss or damage.

The visitors may visit the web site of Government site Like Income Tax Department, Services Tax, Excise, Etc for resolving their doubts or for clarifications.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.